The UPSA Credit Union has adopted new resolutions aimed at further improving its services. This was at the Union’s 2021/2022 Annual General Meeting (AGM) held at the Justice Aryeetey Auditorium on Thursday, June 22, 2023.

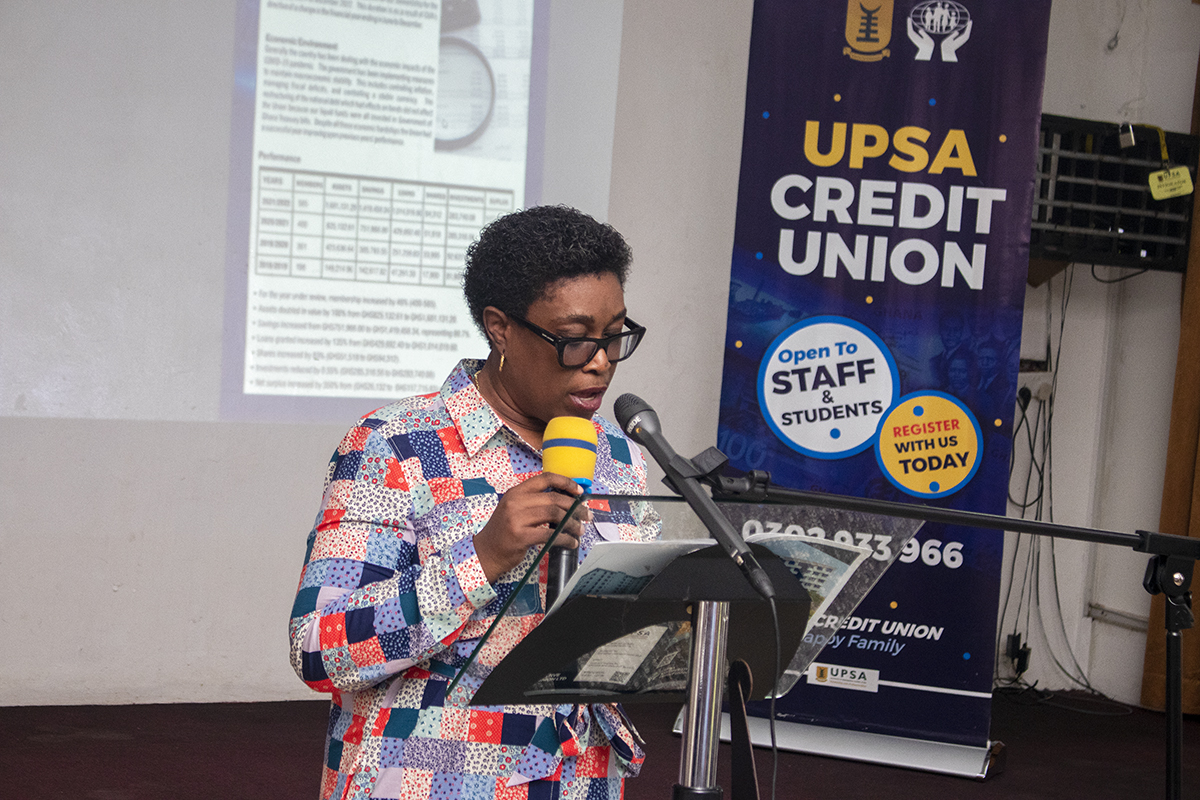

The President of the UPSA Credit Union, Dr Philomena Dadzie, expressed gratitude to members for their continued support and emphasized the importance of collaboration in shaping the credit union’s future trajectory.

One of the key highlights of her presentation was the announcement of impressive financial growth and stability over the fiscal year.

She also reported a substantial increase in the union’s assets over the past year, a testament to its sound management practices and dedication to serving the university community.

“For the year under review, membership increased by 46 percent (from 400 to 585) and our assets doubled in value from GHS825,132.60 to GHS1,681,131.20,” Dr Dadzie announced.

“Savings increased from GHS751,966.00 to GHS1,419,458.34, representing an 88.7 percent improvement. Loans granted increased by 135 percent, shares increased by 83 percent, investments reduced by 0.55 percent, and our overall net surplus increased by 350 percent, from GHS26,132 to GHS117,715.83.”

The Greater Accra Regional Manager of the Ghana Cooperative Credit Unions Association (CUA), Mr Daniel H. Kofi, commended the management board of the UPSA Credit Union for the impressive achievements over the past 12 months.

He said the Union’s annual growth of 48 percent is a remarkable achievement that ought to be celebrated. Mr Kofi urged members to support the scheme while planning and saving toward a brighter future.

In the course of the AGM, several initiatives and resolutions were proposed, discussed, and adopted, reflecting the credit union’s commitment to providing innovative financial solutions and addressing the evolving needs of its members.

Some of the resolutions adopted included an increment of the member shares from GHS200 to GHS500, the payment of 30 percent of the net surplus as dividends to be capitalized into the members’ shares account, and the introduction of the UPSA Kiddie Policy.

The AGM provided an interactive platform for members to voice their opinions, ask questions, and engage in constructive dialogue.

Members expressed their satisfaction with the credit union’s achievements and showed appreciation for the adopted resolutions.